Within Reach: New Mexico Can Be the First State to Close the Racial Homeownership Gap

KELLY O’DONNELL, PH.D. | CHIEF RESEARCH AND POLICY OFFICER, HOMEWISE

Due to the relatively modest size of New Mexico’s homeownership gap and a substantial state budget surplus, New Mexico is well-positioned to be the first state to achieve racial parity in homeownership through forward-thinking public policy.

New Mexico has a 9-percentage point racial homeownership gap: 72 percent of White non-Hispanic households own the home they live in compared to just 63 percent of non-White households.

The homeownership gap is a driving force behind the racial wealth gap. The racial wealth gap contributes to many other racial disparities – in employment, education, and health, to name just a few – that fragment our society and diminish everyone’s quality of life.

In 2021, Homewise engaged PolicyMap™ to map the US racial homeownership gap by city, county, and state. The map tool, available on the Homewisdom website, shows how the rate of homeownership among households of color compares to that of White non-Hispanic households, enabling users to visualize the magnitude of the racial homeownership gaps in their communities and see how their communities compare to others nationwide.

In every US state except Hawaii, rates of homeownership by White households exceed those of non-White households. Nationally, homeownership by households of color lags behind White homeownership by 22.6 percentage points.

New Mexico’s racial homeownership gap is smaller than any other state in the continental US.

Due to the relatively modest size of New Mexico’s homeownership gap and a substantial state budget surplus, New Mexico is well-positioned to be the first state to achieve racial parity in homeownership through forward-thinking public policy.

A 9 percent increase in minority homeownership would close New Mexico’s racial homeownership gap. This could be accomplished by facilitating home purchases by 21,397 (roughly 1-in-6) non-White renter households.

Racial parity in homeownership can be achieved over a 15-year time horizon by facilitating home purchases by 1,450 additional minority households each year.

Not all renters want or are well-suited to homeownership; however, many renters who would prefer to own are deterred by high upfront costs and are unaware of programs, such as down payment assistance and credit counseling, that can help.

Lack of funds for a down payment constitutes the single largest impediment to homeownership for low-income and minority households in the US.

Homewise helps New Mexicans overcome these barriers with down payment assistance and financial coaching.

Increasing the rate of homeownership among low- and moderate-income households will also lessen the profound shortage of affordable rentals, decreasing (but not eliminating!) the need to construct additional affordable rentals.

Closing the racial homeownership gap will not solve the problem of wealth disparity in New Mexico, but it is an important step in the right direction that New Mexico can begin taking today. New Mexico’s unprecedented budget surplus provides an excellent opportunity to address the growing problem of wealth disparity by bridging the racial homeownership gap.

Why does THE RACIAL WEALTH GAP MATTER?

The typical Black or Hispanic American household has less than one-fifth the wealth of the typical White household. The racial wealth gap is the result of numerous factors, most of which are rooted in America’s legacies of both overt and systemic racism. Households of color in the US have lower median incomes than White households, are less likely than White households to benefit from intergenerational wealth transfers (e.g., inheritances and financial gifts from family), and are less likely than White households to own the home they live in. Wealth disparity puts children of color at a disadvantage relative to their White peers, making it harder for them to attain financial security as adults. Families with wealth are better able to invest in their children’s upward mobility through education or by helping them buy their first home or start a business. Families with assets are also better prepared than those without assets to withstand financial setbacks such as illness or job loss.

How does homeownership impact the RACIAL Wealth GAP?

Homeownership is the primary means by which US households build wealth. Racial differences in homeownership rates, while not responsible for the wealth gap, contribute greatly to its size and persistence. Reducing the racial homeownership gap by equalizing access to high-quality loan products, down payment assistance, and a variety of neighborhoods and housing types will enable states like New Mexico to make meaningful progress toward a more equitable and sustainable distribution of wealth.

Why We MAPPED THE GAP

In 2021, Homewise engaged PolicyMap™ to map the racial homeownership gap by city, county, and state in New Mexico and nationwide. The map tool, available on the Homewisdom website, shows how the rate of homeownership among households of color (HOC) compares to that of White non-Hispanic households (White households) at the city, county, and state levels, enabling users to visualize the magnitude of the racial homeownership gaps in their community and compare their community to others nationwide.

Mapping reveals widespread race-based disparities in homeownership throughout New Mexico and the US. In every US state except Hawaii, rates of homeownership by White households exceed those of non-White households. Nationally, 70.1% of White households and 47.5% of HOCs own the home in which they reside, leaving an average racial homeownership gap of 22.6 percent. In New Mexico, where 72 percent of White households and 63 percent of non-White households are homeowners, the gap averages 9 percent, indicating that although homeownership is more equitably distributed in New Mexico than in many other parts of the US, significant disparities remain.

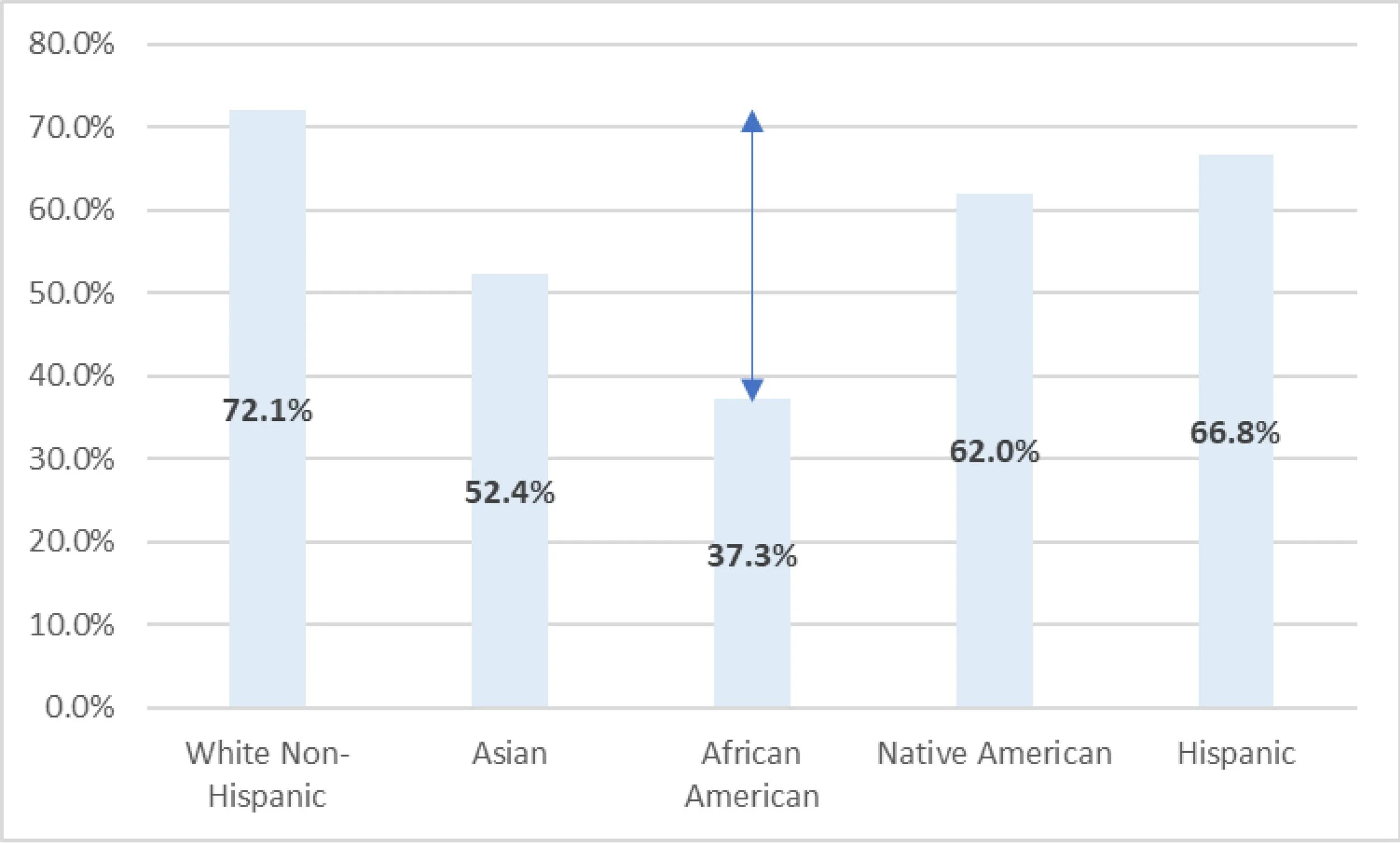

Figure 2: Homeownership Rates and Racial Homeownership Gaps in New Mexico (below)

The size of the homeownership gap also varies by race and by state. The Hispanic homeownership gap ranges from a low of 5.3% in New Mexico to 42% in Massachusetts, while the homeownership gap for Native Americans ranges from 4.4% in Alabama to 49% in Rhode Island, and the gap for African American households ranges from 24% in North Carolina to 59% in North Dakota. Figure 2 shows New Mexico’s racial homeownership gaps.

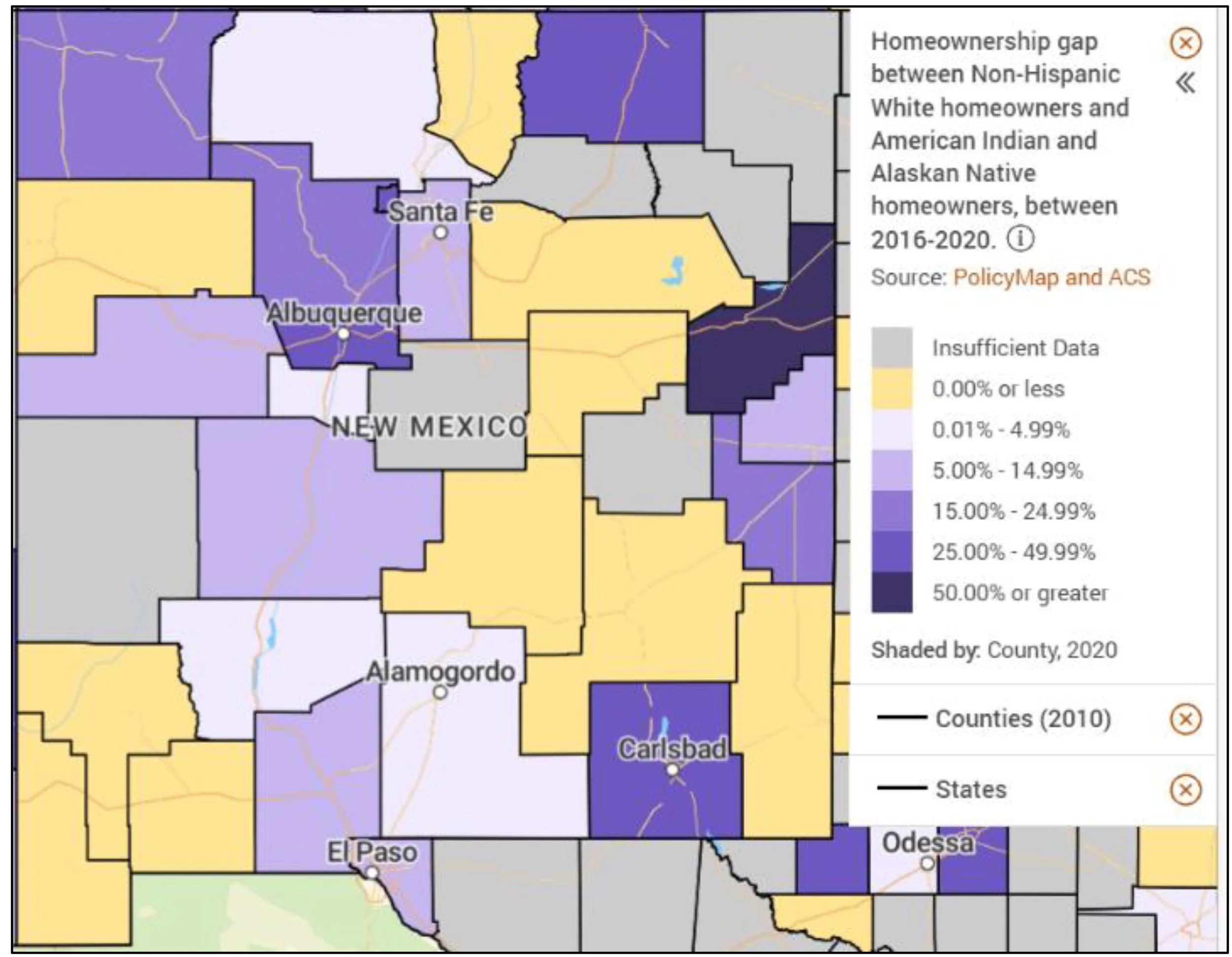

Figure 3: Native American Homeownership (below)

Users of the homeownership gap mapping tool can explore gaps at the city and county levels as well. Figure 3 shows the Native American homeownership gap in New Mexico by county. In several counties, the gap is negative, meaning that the homeownership rate for Native Americans exceeds that of White Non-Hispanic residents. For example, Native American residents of McKinley County are more likely to own the home in which they live than White Non-Hispanic residents. However, it is important to note that Native American homeownership rates lag behind those of White households in all the state’s urban areas, indicating that homeownership initiatives targeting urban Native Americans could help close the gap.

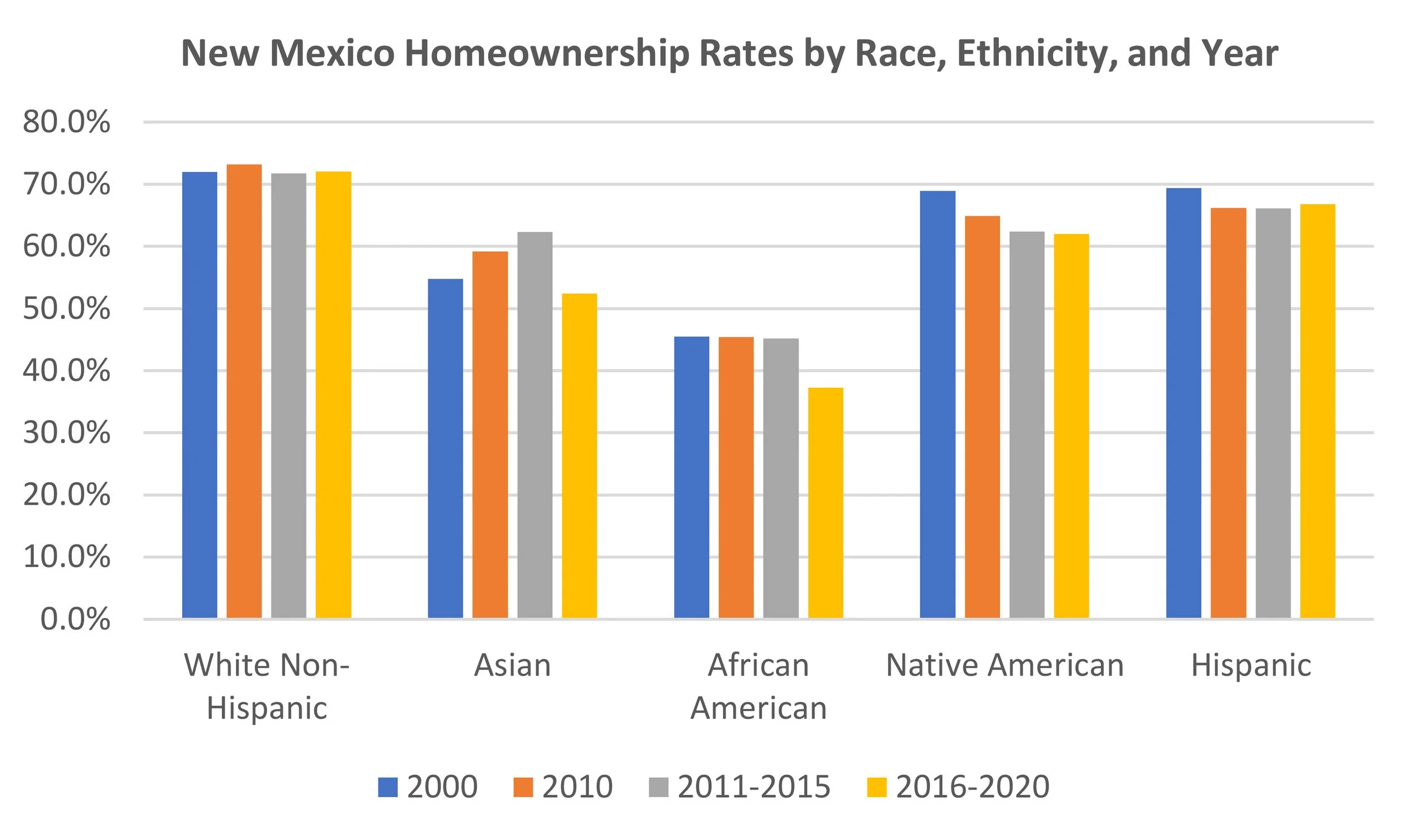

Figure 4: (below)

Gaps in New Mexico Counties

In addition to illustrating the size of a community’s racial homeownership gap, the PolicyMap tool enables users to estimate how many new homeowners of color a community needs to equalize homeownership across the races. Users can then contrast the number of new homeowners needed with the number of renter households in the area with the minimum income needed to buy a home. These data are available by clicking on a location and opening the report that pops-up. Of course, income alone is not sufficient to ensure success as a homeowner. Homeownership potential is influenced by numerous factors, some specific to the prospective homebuyer, such as credit history or immigration status, and others related to housing market conditions, including the supply of housing and prevailing mortgage interest rates. While individual homebuyers have little influence on the state of their local housing markets, they are quite capable of addressing many of the other barriers, particularly if they avail themselves of homebuyer support through community organizations such as the New Mexico Mortgage Finance Authority or Homewise. Unfortunately, misconceptions about the financial requirements of homeownership and a lack of information about the availability of support for new homeowners prevent many renters from even attempting to own a home.

Our new mapping tool also enables users to compare homeownership rates over time. Figure 4 shows New Mexico homeownership rates over the past two decades. During that period, homeownership by White non-Hispanic residents remained relatively constant, while rates for non-White households declined.

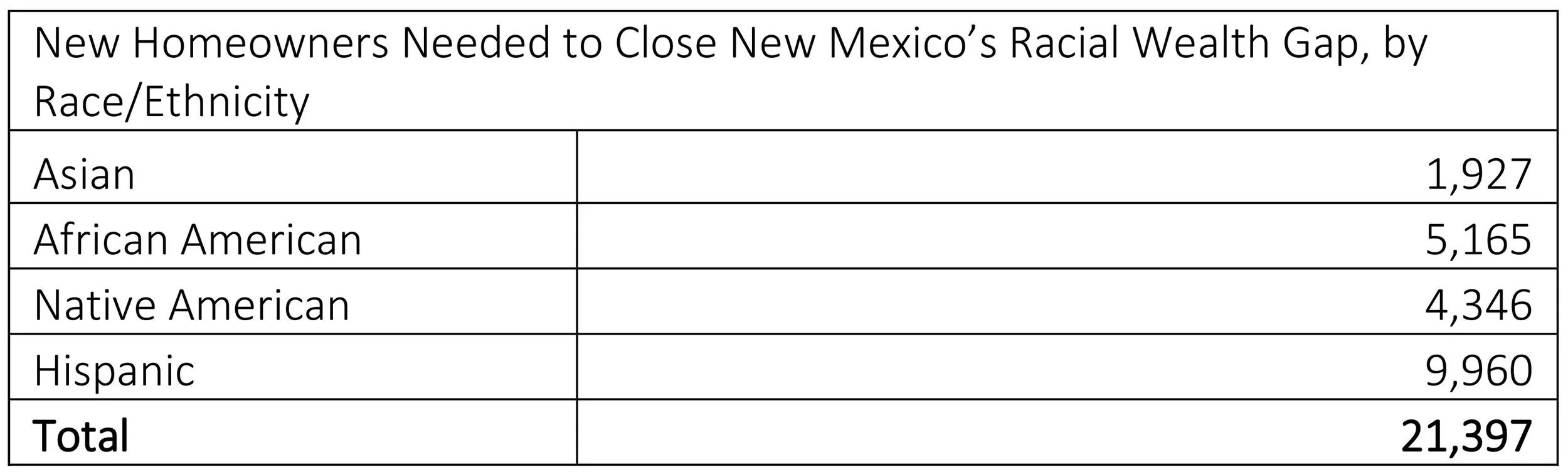

Table 1: (below)

WE CAN CLOSE THE GAP IN NEW MEXICO!

A 9% increase in minority homeownership would close New Mexico’s racial homeownership gap. This can be accomplished by facilitating home purchases by 21,397 (roughly 1-in-6) non-White renter households. Table 1 shows the number of additional homeowner households needed to close the racial homeownership gap in New Mexico.

closing the gap benefits renters too

New Mexico, like many places in the US, has an extreme shortage of affordable housing, resulting in overcrowding, substandard living conditions, high rates of residential mobility, and homelessness. The New Mexico Mortgage Finance Authority estimates that New Mexico needs at least 32,000 additional affordable housing units to meet current demand. While homeownership can’t solve the housing crunch for everyone, moving low- and moderate-income renters who want and can afford homeownership into homes of their own stabilizes their housing and frees up sorely needed affordable rental units for other struggling families.

Closing the racial homeownership gap will not solve the problem of wealth disparity in New Mexico. Still, it is an important step in the right direction that New Mexico can begin taking today. New Mexico’s unprecedented budget surplus provides an excellent opportunity to address the growing problem of wealth disparity by bridging the racial homeownership gap.

Interested in learning more about the wealth gap?